Digital Banking Features

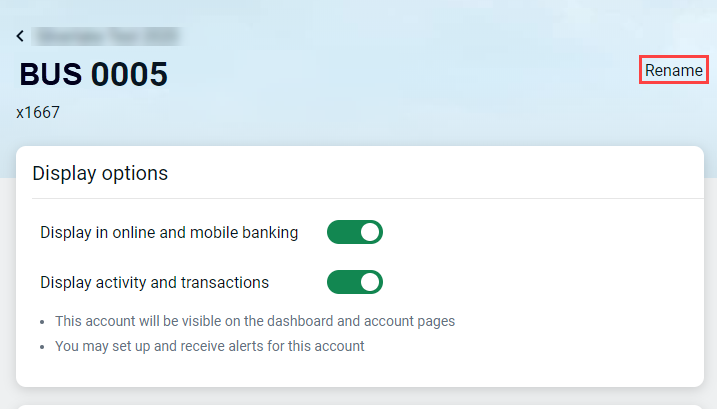

Customizable Dashboard

You decide what gets priority on your screen. Put balances, transactions, payments, transfers, and messages in any order.

Mobile Deposit

Quickly deposit checks using the camera on your phone. Mobile App only.

Zelle®

Quickly and easily send money to friends and family with

Zelle.

Debit Card Controls

Temporarily lock your card or set alert preferences, spending limits, or restrictions.

Personal Budgeting Tool

Track expenses by category and set saving or spending targets. Get a complete picture of your finances by pulling in account info from other financial institutions.

Payments

Send payments from anywhere to anyone with our Bill Pay function.

Electronic Documents

Store your monthly statements and account notices securely for access anytime.